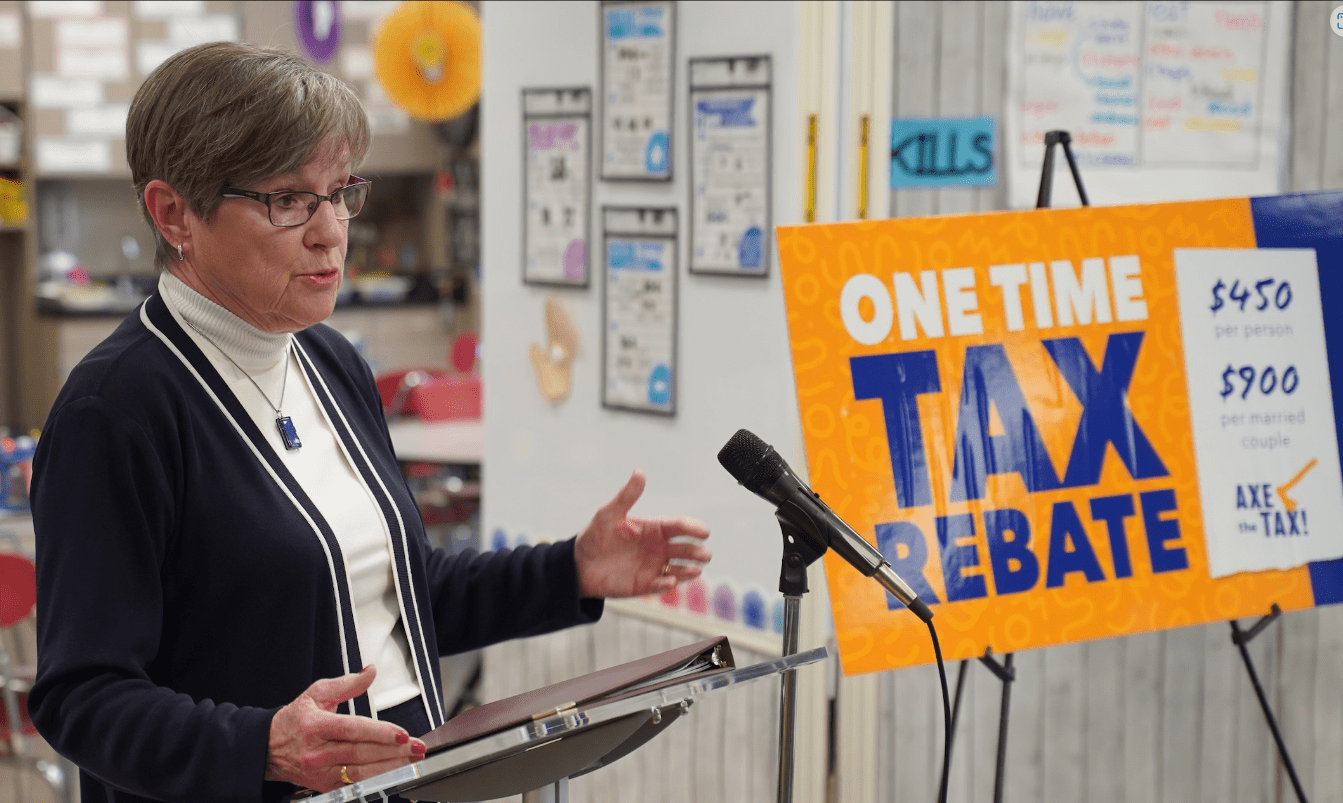

Kansas Governor Laura Kelly said Monday she has vetoed a bill that establishes a flat tax rate, and she is calling instead for a tax rebate of $450 to individual taxpayers and $900 for married couples filing jointly.

The governor made the announcement during an appearance at a Topeka elementary school. She said Senate Bill 169, which would establish a 5.15 percent flat income tax rate, would cost the state $1.3 billion over the next three years and put public education funding at risk.

The governor compared the flat tax proposal to the “tax experiment” under former governor Sam Brownback, and she said it would pose risks for public education, roads and bridges and other essential services:

“This bill would upend our tax system and throw our state’s budget out of balance long-term. There is no question: Just like under my predecessor, this tax plan would be paid for by cutting funds from our public schools. Already, those same legislators have proposed cutting millions of dollars from public schools, and particularly rural schools. I won’t stand for cuts to our public schools, period.

“To be very clear, I want to cut taxes for everyday Kansans. That’s why I’ve proposed targeted, responsible tax cuts on groceries and Social Security, and it’s why I’m proposing a tax rebate, this year, of $450 for individual taxpayers and $900 for married couples filing jointly.”

The governor is proposing the use of a one-time budget surplus to fund the tax rebate.

Kansas Chamber president and CEO Alan Cobb released a statement critical of the governor’s veto:

“State tax receipts have climbed nearly 30% during the last three years. Offering modest tax relief to Kansans struggling to pay for daily necessities seems to be a no brainer. Governor Kelly vetoed tax changes in 2019, 2020, and 2021, saying those proposals would destroy the state’s budget. They didn’t. And this plan won’t either.”

Cobb called on Kansas lawmakers to override the governor’s veto.