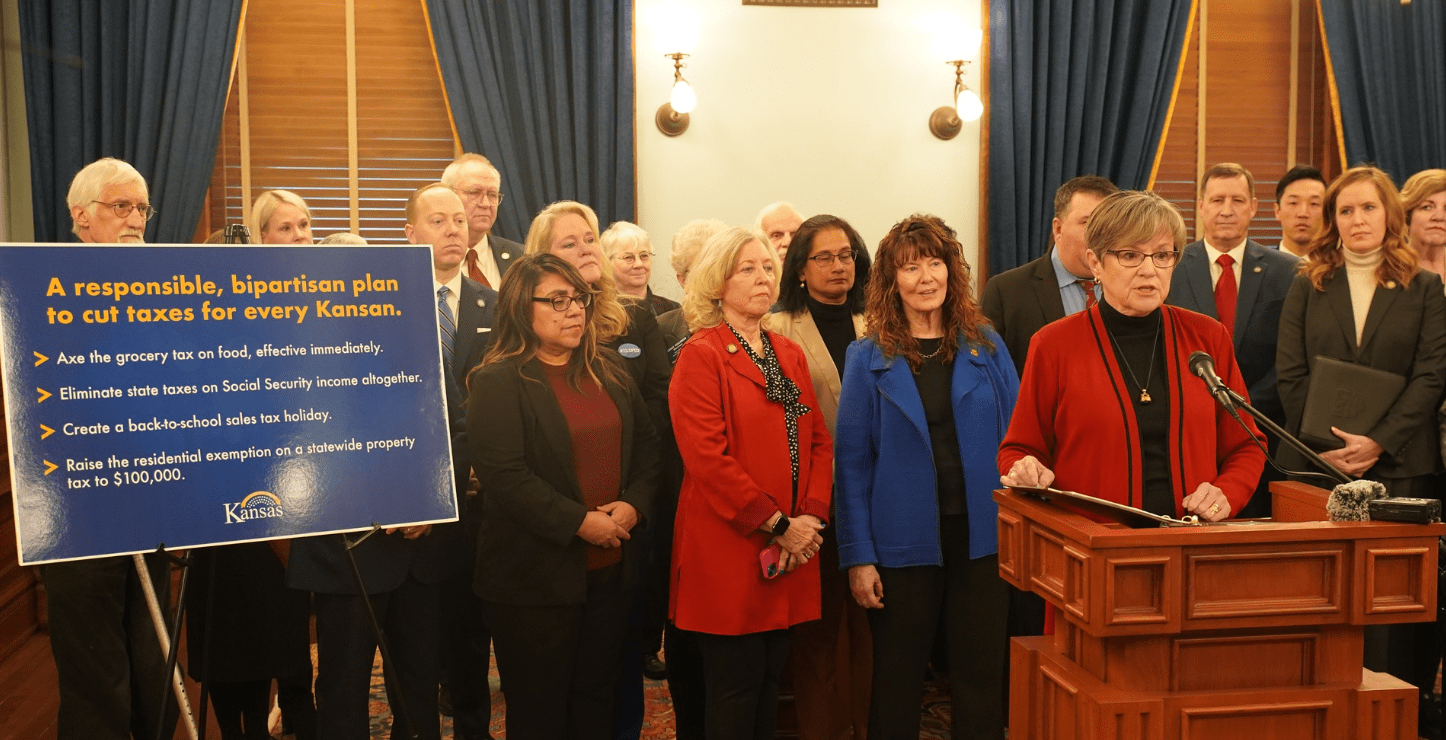

Kansas Governor Laura Kelly and a bipartisan group of lawmakers have announced a comprehensive tax cut proposal that will be introduced in the next legislative session.

The plan will exempt the first $100,000 in state property taxes for all Kansas homeowners. When it’s fully implemented, the plan would save all Kansas homeowners a total of $100 million a year, and 370,000 homeowners would pay less than 20 dollars a year in state property tax.

The plan would entirely eliminate state taxes on Social Security income. It would also increase the standard deduction so Kansans will pay less on their state income taxes.

The plan will also immediately end the state sales tax on groceries, diapers and feminine hygiene products, and it doubles the Child and Dependent Care Tax Credit that parents can claim to help pay for child and dependent care while they work or attend school.

The bill will also create a back-to-school state sales tax holiday. This would be a four-day holiday to provide tax relief on clothing, school supplies, computer software and computers and computer supplies.

Governor Kelly said the entire plan will save Kansans more than $1 billion over three years, and it will cut taxes for every Kansan while maintaining the state’s strong fiscal standing.

The governor announced the plan Monday at a Statehouse event with Republican senators John Doll of Garden City and Rob Olson of Olathe, along with Independent senator Dennis Pyle of Hiawatha and Senate Democratic Leader Dinah Sykes of Lenexa. The governor said the plan provides relief for middle-class Kansans, it’s fiscally responsible, and it keeps seniors and families in their homes, which is why it has received bipartisan support.